Beware the Silent Thief

Author: Owen Cooney

Inflation is top of mind for many New Zealanders this year as we get used to the idea of higher prices. Rising values feel great when you’re benefitting from them (such as property owners in recent decades) but the same can’t be said when you’re paying extra at the supermarket checkout or petrol pump.

The juxtaposition between these two scenarios is interesting to consider. I recently experienced the power of artificial intelligence via an AI tool called ChatGPT (with the assistance of my 25 year-old daughter of course!). I asked the system the following questions:

“What is the average increase in value of commercial property in New Zealand over the last five years?”

In a split second it came back with a bunch of information that included:

“Over the last five years, the New Zealand commercial property market has continued to experience growth, although the rate of growth has varied depending on the location and type of property. According to the Real Estate Institute of New Zealand (REINZ), between March 2016 and March 2021, the national median sales price for commercial and industrial property increased by approximately 47% from $491,000 to $720,000. This represents an average annual growth rate of approximately 8.1%.”

Then I asked,

“what about the last 10 years?”

“Between March 2011 and March 2021, the national median sales price for commercial and industrial property increased by approximately 73% from $416,000 to $720,000. This represents an average annual growth rate of approximately 5.5%.”

Then I asked,

“what about the last 20 years?”

“According to the Real Estate Institute of New Zealand (REINZ), between March 2001 and March 2021, the national median sales price for commercial and industrial property increased by approximately 308% from $176,000 to $720,000. This represents an average annual growth rate of approximately 8.8%.”

I knew there had been significant increases over time – but even I was a little surprised at the extent of the increase over these periods.

It brought to mind a comment made by a successful property person recently when he said, “the real money is made in property by holding, not selling!”

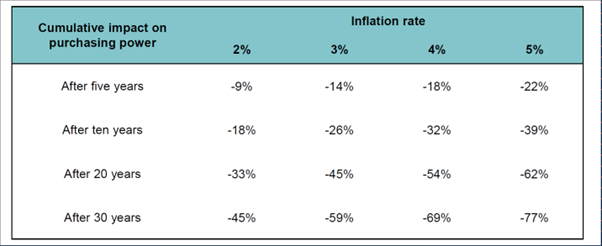

It also prompted me to take another look at this schedule I obtained at a recent presentation showing the effects of inflation.

As you can see, even at an annual inflation rate of 2% the spending power of one dollar is reduced to 91 cents over five years and at 5%, it is reduced to 78 cents!

So what is the lesson here?

Two things seem clear to me:

- Inflation is a silent thief; and

- Unless you have some of your wealth invested in growth assets, then is your money really safe in the bank?

Or is that the ideal location for the silent thief to do its work?