Into the Horizon: What’s ahead for Commercial Property?

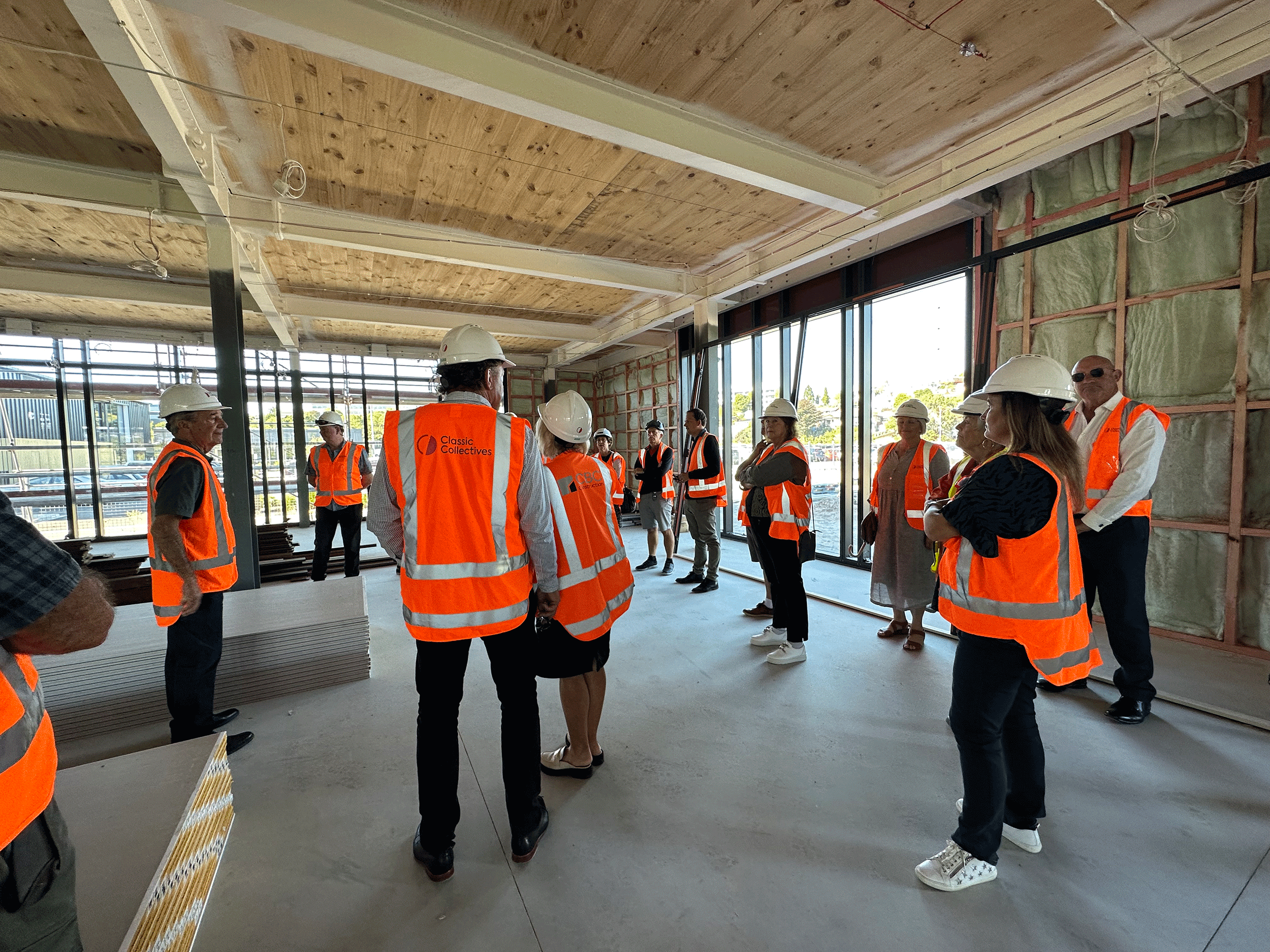

In this interview, we sit down with Classic Collectives director, Daniel Watkins, to gain valuable insights into the future trajectory of the commercial property market. We explore his perspectives on commercial property values, demand, inflationary drivers, and more, shedding light on the potential developments in the next 5-10 years.

Question: Where do you see commercial property values and the demand for commercial properties heading in the next 5-10 years?

A significant proportion of commercial properties have their rental growth linked to Consumer Price Index (CPI) or fixed rental growth mechanisms, providing a stable foundation for value appreciation. Moreover, factors such as increased build costs and limited land supply are restricting new construction, leading to a surge in costs for new builds and subsequently putting pressure on rents to increase to cover these costs.

Question: Building costs are a major inflationary driver and interest rates have moved upwards. What does that mean for commercial property in the future?

Building costs and interest rates play crucial roles in shaping the commercial property market’s dynamics. Rising interest rates affect the capitalisation rates of buildings, influencing the cash returns on investments. Regardless of the future direction of the official cash rate (OCR), it will impact property values, creating both challenges and opportunities for investors. However, there is some good news on the horizon with an improvement in rental returns due to CPI rent reviews capturing the significant inflation experienced in recent years. Interestingly, the combination of escalating building costs and softened capitalisation rates has resulted in a gradual slowdown in building activity.