Boutique Commercial Opportunities for Hands-On Investors

In the world of real estate investing, one size does not fit all. While some investors prefer the hands-off approach of REITs or large-scale syndications, there’s a growing segment of experienced investors who prefer the idea of a more personalised, hands-on experience.

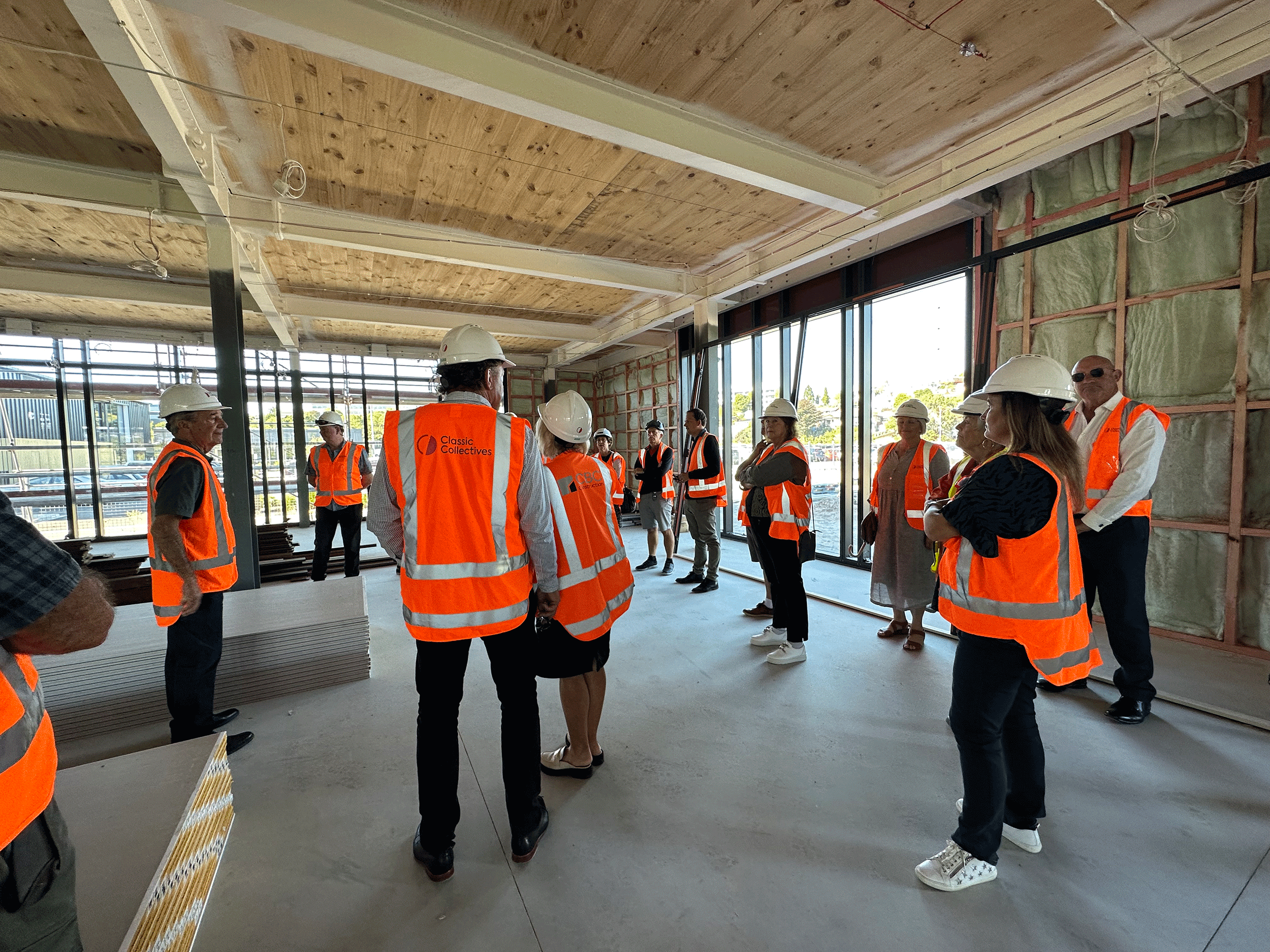

At Classic Collectives, we cater specifically to these investors. In this article, we explore the concept of boutique commercial syndication and the benefits it offers to investors who prefer a more intimate and active role in their commercial real estate assets.

The Rise of Commercial Syndication.

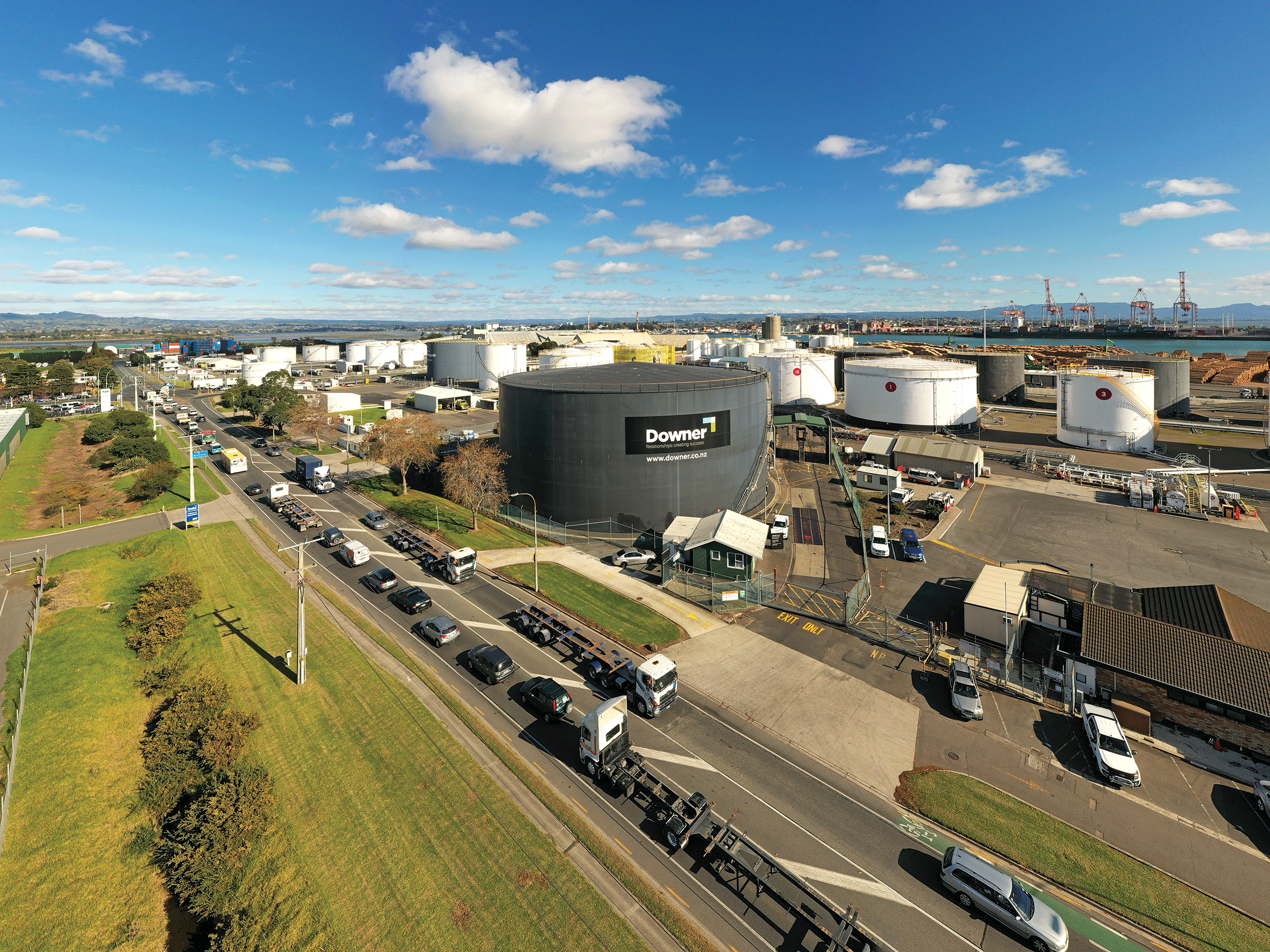

Syndicated commercial real estate opportunities have become increasingly appealing to a growing number of individuals seeking entry into the commercial and industrial property markets. These opportunities serve as a reliable hedge against inflation and an effective wealth-building strategy. They offer a platform for both newcomers and seasoned investors to participate as partners in high-quality properties. These properties boast robust fundamentals, including prime locations and secure, long-term tenant agreements. This trend emerges following a notable shift in the commercial real estate landscape in 2022, as private investors took the lead in acquisitions, surpassing institutional investors for the first time, as revealed by recent research conducted by Knight Frank.

Personalised approach.

One of the primary advantages of our approach at Classic Collectives is the more personalised approach to real estate investment. We know each of our investors by their first name and ensure they are as actively engaged in the decision-making process as they wish to be. From property selection and acquisition to management and exit strategies. This level of involvement allows investors to tailor their investments to their preferences and financial goals.

Stronger Network and Relationships

Our boutique approach to commercial real estate investment fosters close-knit relationships among investors. Being part of a smaller group allows for more meaningful connections, shared knowledge, and mutual support. These networks can extend beyond the investment itself, creating valuable business relationships that can last a lifetime.

Greater Control and Transparency.

In larger syndications, decision-making often falls into the hands of a few key players. In Classic Collectives, investors have more say in how the property is managed and operated. This increased control leads to greater transparency and accountability, ensuring that investors’ interests are front and centre.

Flexibility in Asset Selection.

Our syndications can be tailored to target specific types of real estate assets, such as medical facilities, early childhood education centres, industrial warehouses, or office buildings. This flexibility allows investors to focus on assets that align with their expertise and investment goals.

Learning Opportunity.

For those looking to gain valuable hands-on experience in commercial real estate investing, Classic Collectives provides an ideal learning platform. If the commercial sector is new to you, you can benefit from the knowledge and expertise of more experienced members while actively participating in the decision-making process.

Conclusion.

Investors are showing a growing inclination towards commercial real estate as a means to enhance their wealth and safeguard against inflation. Commercial syndications present an opportunity for individual investors to tap into premium commercial assets that might otherwise be beyond their grasp. If you’re eager to delve deeper into how Classic Collectives can provide a more hands-on and personal experience in your commercial real estate endeavours, we invite you to connect with us. Our close-knit community of investors fosters greater transparency and intimacy, ensuring a richer and more rewarding journey.