Why Commercial Rents Are Only Heading One Way – Up

Despite disrupted cash flow from high interest rates, promising signs indicate that commercial building values will soon rise, offering capital gains for patient investors.

When high interest rates ruin your cash flow, it can be hard to keep a positive eye on the investment horizon. Yet, in our opinion, there are clear signs that commercial building values should soon rise, meaning capital gains await those who are patient enough to receive them.

Following on from last month’s article ‘what does the long game look like for property investors?’ we have been keeping a close eye on construction costs to see what impact they will have in the long term.

Analysing the numbers

Building costs effectively underpin commercial values. Right now, there is hardly any new commercial builds happening because the capitalisation rate investors require (i.e. the rate of return based on the income the property is expected to generate) doesn’t cover the cost of constructing it in the first place. This is despite the fact that building costs are now settling down after steep price hikes.

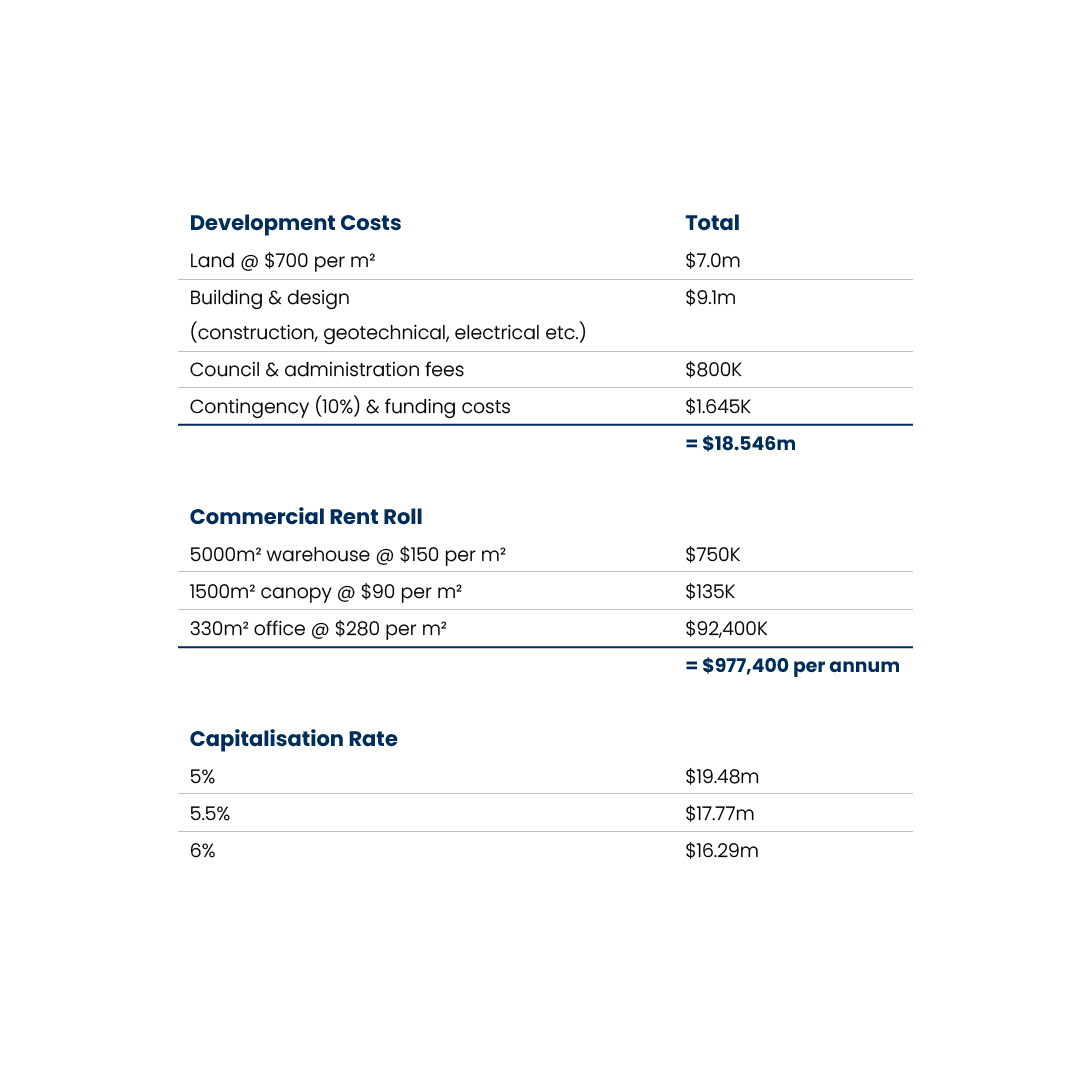

Have a look at this fictional example (based on current market rates) of a new 5000m² warehouse in Tauriko, Tauranga featuring a 1,500m² canopy and 330m² of office space on a 10,000m² site.

Given current interest rates…

Investors want a 6% or greater return right now which puts the building’s value at $16.29m. However, it would cost around $18.5m to build. It’s no wonder developers are sitting tight and few land transactions are occurring.

Developers would ideally want to sell this building for $22m to make a decent 20% return. In fact, some developers are having to take a hit at the moment and sell new builds for less than cost, just to pull their capital out. Classic Collectives Ltd was recently able to pick up one such build for $2m less than the cost of construction.

So what does this mean for the value of existing commercial buildings?

Sit tight because higher rents are on the way

Currently there are two levers you can pull to increase a property’s value – rental rates and the capitalisation rate (return to the investor). Interest rates will start falling eventually and businesses will want to expand. To justify new builds, rents are going to have to increase significantly to offset the cost inflations we’ve seen over the past three years – which means the rental returns for existing commercial stock should rise as well. In other words, the building you own now should become a lot more valuable as rents rise across the board.

While this market recovery might still be 2-3 years away, now is the time to start positioning yourself to take advantage of what’s coming.

Talk to the Collectives team today about your next move

Our Classic Collectives only invest in premium commercial properties that already exist. These may be brand new builds but they’re tenanted and ready to go. We don’t invest at the development stage so we aren’t exposed to the risk of construction costs and potentially making a loss in the current market.

As a result, our investors own a slice of a first-class asset and stand to benefit in the long-term from rising rental returns. Property investment is all about playing the long game. So it’s worth taking a lesser return now, riding out the squeeze on your cash flow, and keeping your focus firmly on that 10 year+ horizon.

EMAIL: daniel.watkins@classic-group.co.nz

PHONE: 027 577 1755