Understanding the Economic Cycle to Shape Your Next Investment Move

We are all subject to political cycles, weather cycles and of course, economic cycles.

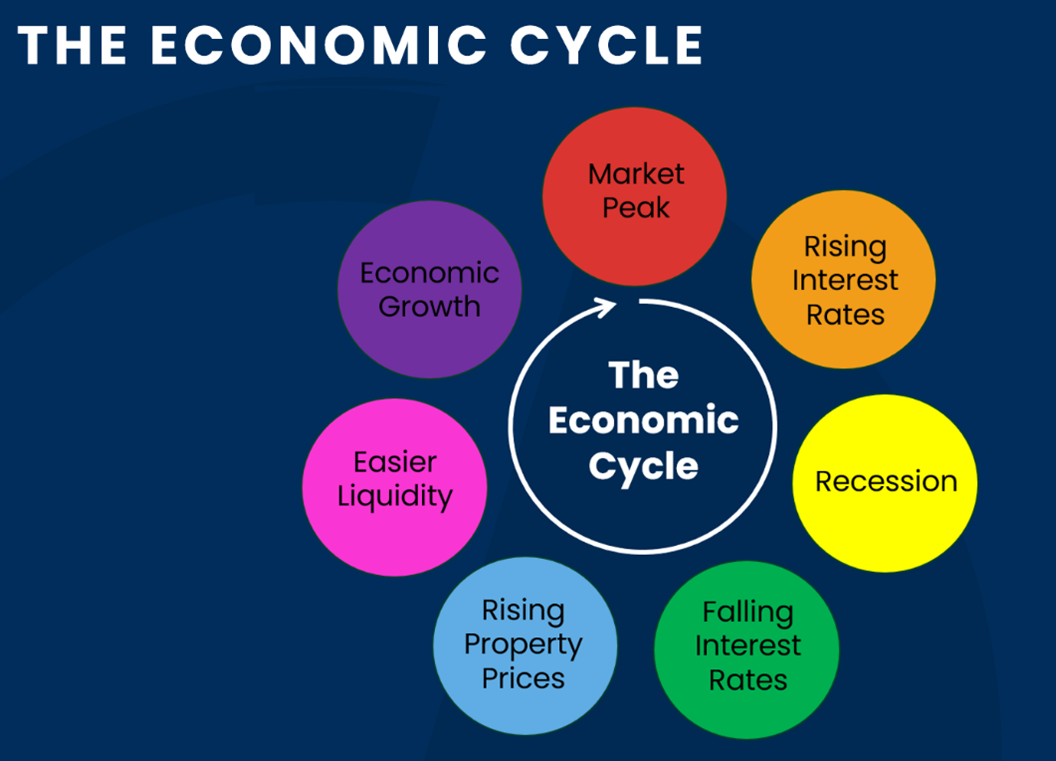

Our capitalist economy is based on self-correcting phases which broadly follow the pattern outlined in the graphic below. You could view this cycle as a clock face with the market peak representing 12 o’clock.

The Economic Clock – How Unforeseen Events Shape the Cycle

Each cycle typically begins and ends with something unexpected happening which kicks the pattern off again. Four years ago, the Covid-19 pandemic and subsequent lockdowns resulted in governments and central banks flooding the market with cash (8 o’clock) which then fueled economic growth (10 o’clock). We soon hit market peak which forced our Reserve Bank to begin hiking interest rates (1 o’clock) to get inflation under control, and we’ve battled our way through recessionary conditions (3 o’clock) for the past two years.

So here we are at 5 o’clock, and we can see exactly what’s coming next. The timing of the next stage is the only unknown factor – how quickly and how far will the property market rise in 2025 and beyond?

Hunting opportunities

Now is the time to look at quality investment assets because once we tick past 6 o’clock, others are in the game and it becomes a lot harder to secure a great deal.

We are actively looking for premium commercial investments in Auckland, Hamilton, Tauranga and Christchurch right now. While we would love to add another asset to our medical fund in particular, we are keeping an open mind.

The key is to find premium assets that offer good growth potential, long-term leases, and A grade tenants (i.e. ones who are resilient and reliable and can offer a steady income stream regardless of the economic climate).

Are you ready?

While we are working hard to find ideal commercial properties, we encourage potential investors to get in touch with us now so we can move quickly when the right opportunity presents itself. If you would like to be among the first to know about any new investments, please reach out so we can add you to our initial contact list.

As always, if you have any questions or would like to know more, feel free to get in touch.

EMAIL: Owen.Cooney@classiccollectives.co.nz

PHONE: 027 222 6932