Rising Competition Heats Up Commercial Market

The commercial property market is usually ahead of the game when it comes to pricing.

The Reserve Bank’s decision to cut the OCR by 50 basis points in February was anticipated well in advance. But New Zealand’s residential housing market tends to react to the ‘now’. People don’t start planning ahead or making offers until mortgage rates actually drop.

In contrast, prices for commercial property are already shifting into high gear. We’ve noticed increasing competition among potential buyers for prime assets and prices are now firming up quite solidly.

Capitalisation rates for desirable commercial properties are currently sitting in the 5% range and will possibly compress further as anticipated OCR cuts are rolled out. To understand the effect this has on prices, consider a building with an annual rental income of $1m. It will command a $16.6m purchase price at a 6% cap rate. But if that cap rate falls to 5.5%, suddenly the building is worth $18m.

Given there is now price movement and more activity out there, prime assets will soon be in hot demand. If you recall our previous blogs on the economic cycle, this is the next phase in our ‘ticking clock’ analogy that we have been alluding to in recent months.

So what does this mean for Classic Collectives?

For our current investors, congratulations. For new investors, it’s time for us to make our next move.

We are actively looking for premium commercial investments in Auckland, Hamilton, Tauranga and Christchurch. We would love to add another asset to our medical fund and we also see the merits for prime industrial assets with a view to launching a new industrial fund with 3-4 (or more) quality properties. Logistics in particular (with the increase in online shopping) is a growth area.

However our search scope is wider than industrial only as we know there are other categories of prime assets.

Purchasing multiple properties will give us the benefit of scale which in turn, provides more leverage with the banks so we can get lower rates. It also provides more flexibility in terms of future exit opportunities. We could offload individual properties in the right circumstances, or the fund could be an attractive acquisition for a big player who is looking to add to their portfolio.

Gold standard

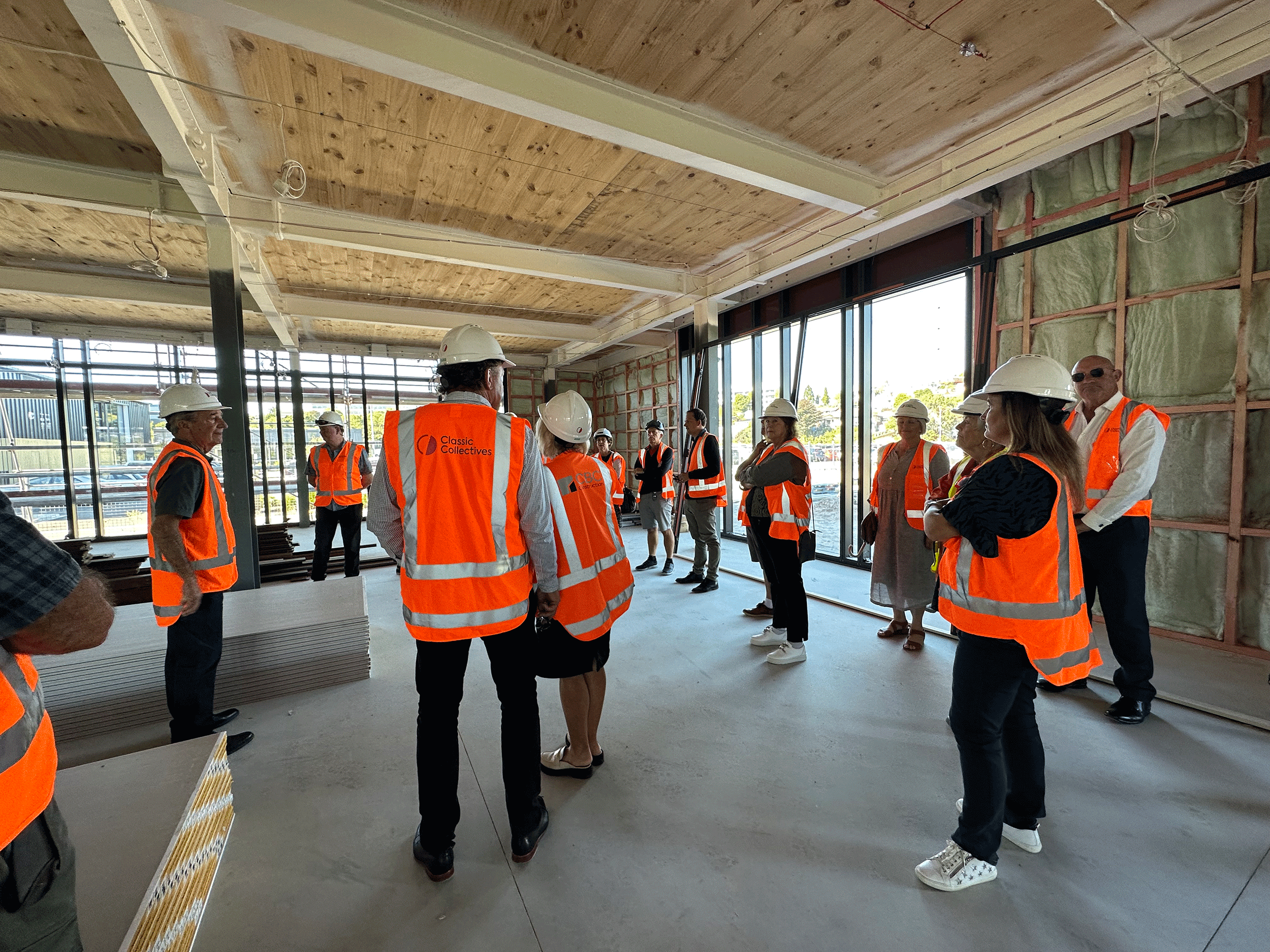

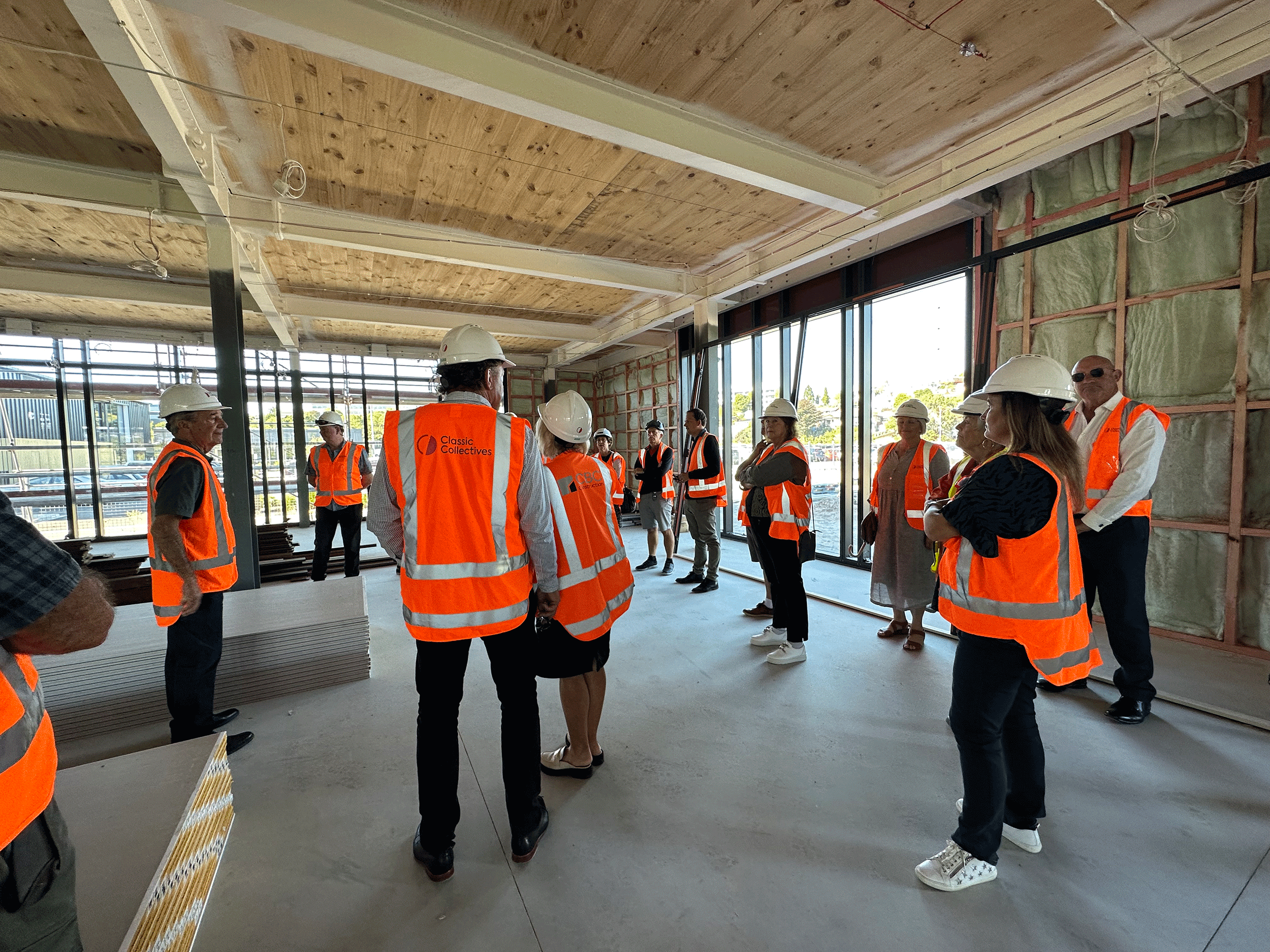

While we are keen to scale-up our next fund, we still want to retain the bespoke dynamic we’ve become known for. We know investors value our transparency, communication and the connectivity we provide in terms of site visits and regular reporting. We only invest in what we perceive as premium properties, and you can expect the very best service from us as well.

We already have our eyes on one particular industrial property and are confident more will turn up in the very near future. We will keep you updated! As always, if you have any questions or would like to know more, feel free to get in touch.

- Email: owen@classiccollectives.co.nz

- Phone: 027 222 6932