We bring investors together in ownership of exceptional commercial assets.

Welcome to Classic Collectives

Commercial Property Syndication and Management.

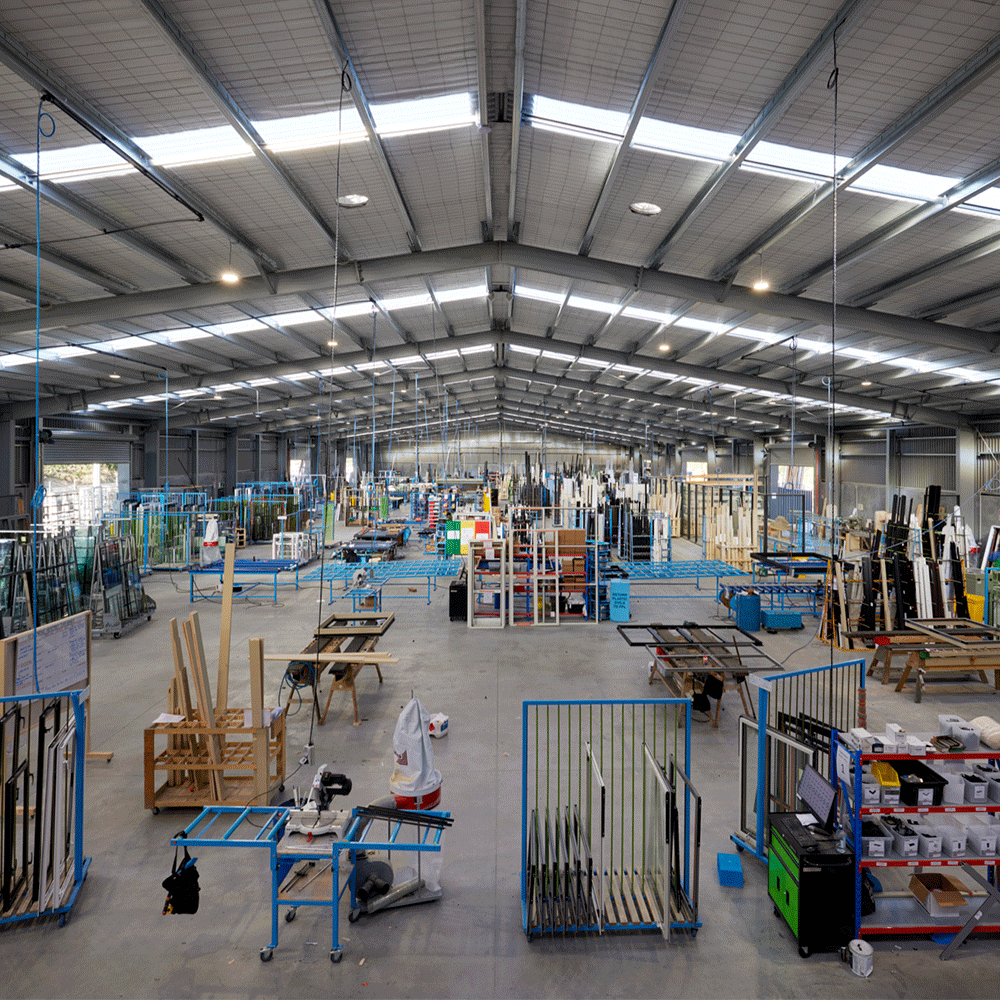

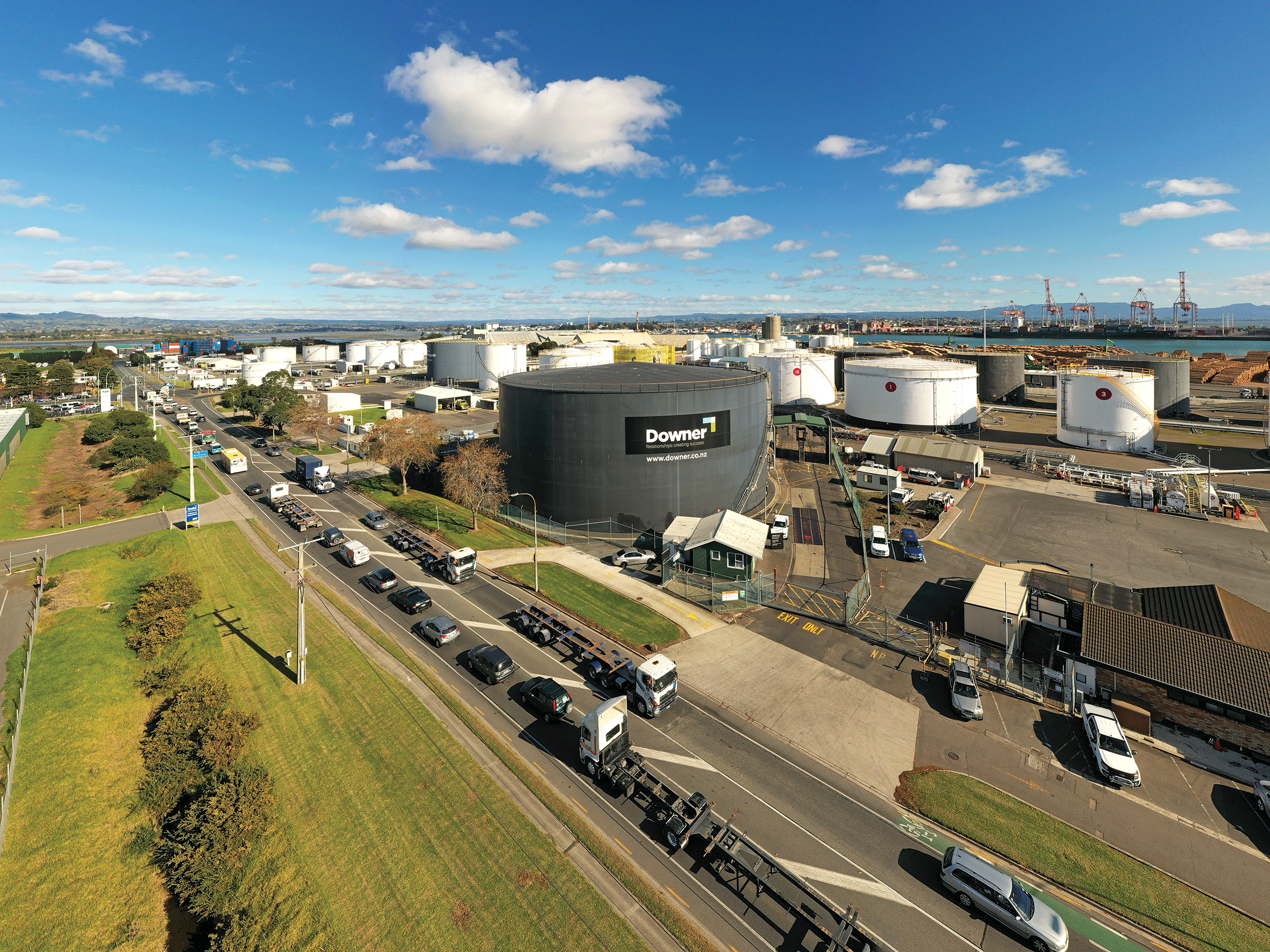

Our specialty and passion lie in pursuing premium commercial and industrial properties and bringing together small syndications of investors to share in their ownership. We oversee the entire commercial and industrial property lifecycle, encompassing asset acquisition, fund establishment, capital raising, leasing, and property management. We’re discerning with the opportunities we bring to our investors and, through our networks and affiliations across the property sector, actively seek exceptional opportunities that provide reliable cash returns and capital growth potential over the long term.

Welcome to Classic Collectives

Commercial Property Syndication and Management.

Our specialty and passion lie in pursuing premium commercial properties and bringing together small syndications of investors to share in their ownership. We oversee the entire commercial property lifecycle, encompassing asset acquisition, fund establishment, capital raising, leasing, and property management. We’re discerning with the opportunities we bring to our investors and, through our affiliations across the sector, seek exceptional opportunities that provide reliable cash returns and capital growth potential.

Opening Doors to Prime Commercial Ownership.

Classic Collectives provides wholesale investors the opportunity to own a stake in premium commercial and industrial assets typically out of reach as individuals. We bring investors together to create small, tight-knit syndications of investors to pool resources and share in ownership. Our commercial property syndications are typically between 12-15 people, depending on the property and the desired level of investment. The properties we target typically sit in the $10m+ range as premium assets that attract premium tenants. We are at the forefront of the industry, identifying and securing highly sought-after assets with real-time insights to move faster and more confidently on opportunities.

Opening Doors to Prime Commercial Assets.

Classic Collectives provides wholesale investors the opportunity to own a stake in premium commercial and industrial assets typically out of reach as individuals. We bring investors together to create small, tight-knit syndications of investors to pool resources and share in ownership.

Our commercial property syndications are typically between 12-15 people, depending on the property and the desired level of investment. The properties we target typically sit in the $10m+ range as premium assets that attract premium tenants.

OUR GUIDING PRINCIPLES